Military Spouse Residency Relief Act Tax Form

form wallpaperHowever the Military Spouse Residency Relief Act doesnt automatically extend this exemption to a spouse. Generally speaking the state that you live and work in during any given tax year is the state in which you are required to pay taxes.

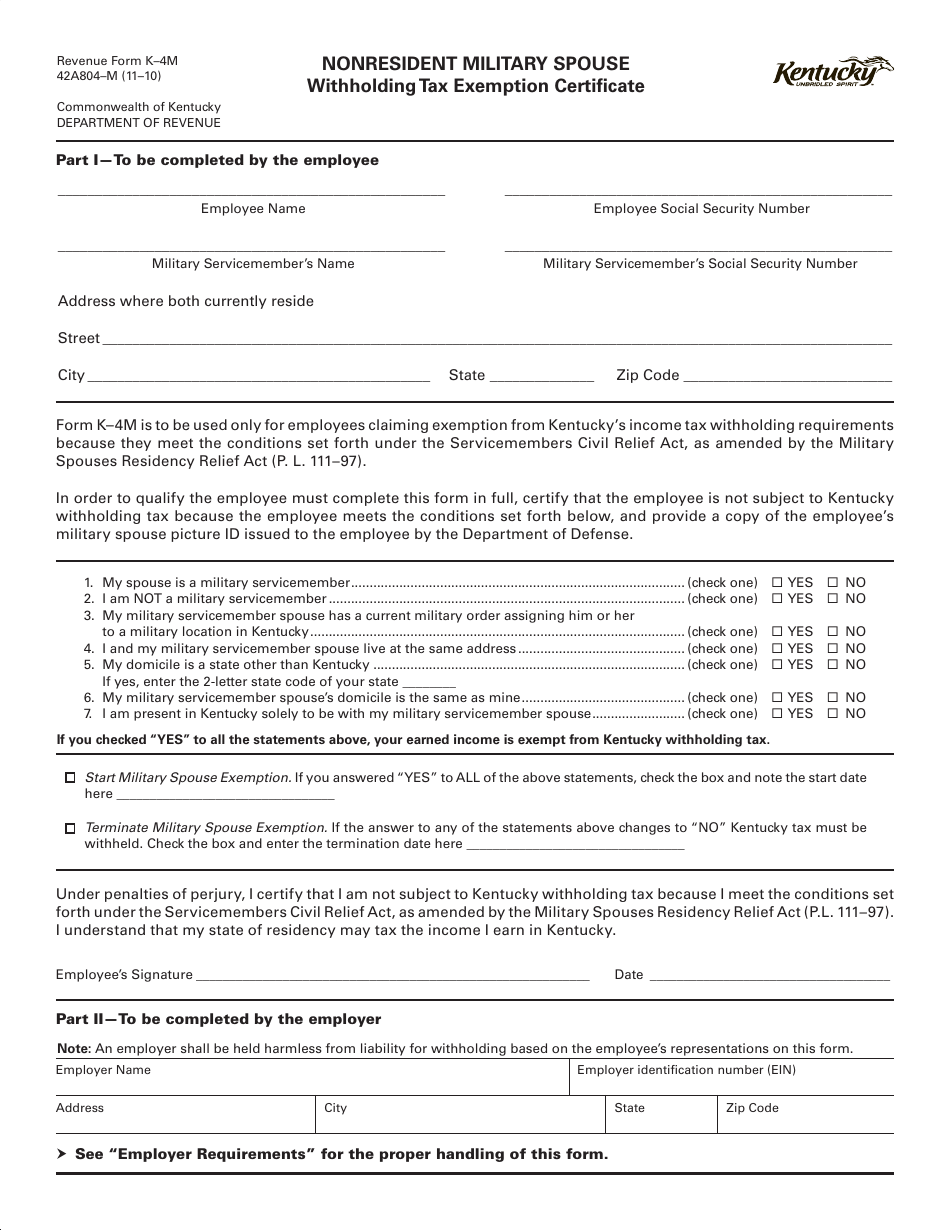

Form K 4m Download Printable Pdf Or Fill Online Nonresident Military Spouse Withholding Tax Exemption Certificate Kentucky Templateroller

A spouse making this election will be considered to be domiciled in the same state as the servicemember.

Military spouse residency relief act tax form. If you re a military spouse covered by the military spouse residency relief act you ll file your state return in your state of legal residence. For tax years beginning January 1 2018 the Veterans Benefits and Transition Act of 2018 amended the Servicemembers Civil Relief Act to allow the spouse of a servicemember to elect to use the same residence as the servicemember for state tax purposes. If youre a military spouse covered by the Military Spouse Residency Relief Act youll file your state return in your state of legal residence.

Use Form 763-S to request a refund. This Act allows a servicemembers spouse to keep a tax domicile legal residence throughout the marriage even if the spouse moves into California so long as the spouse moves into California to be with a servicemember who is in the state because of military orders. In order to qualify you must.

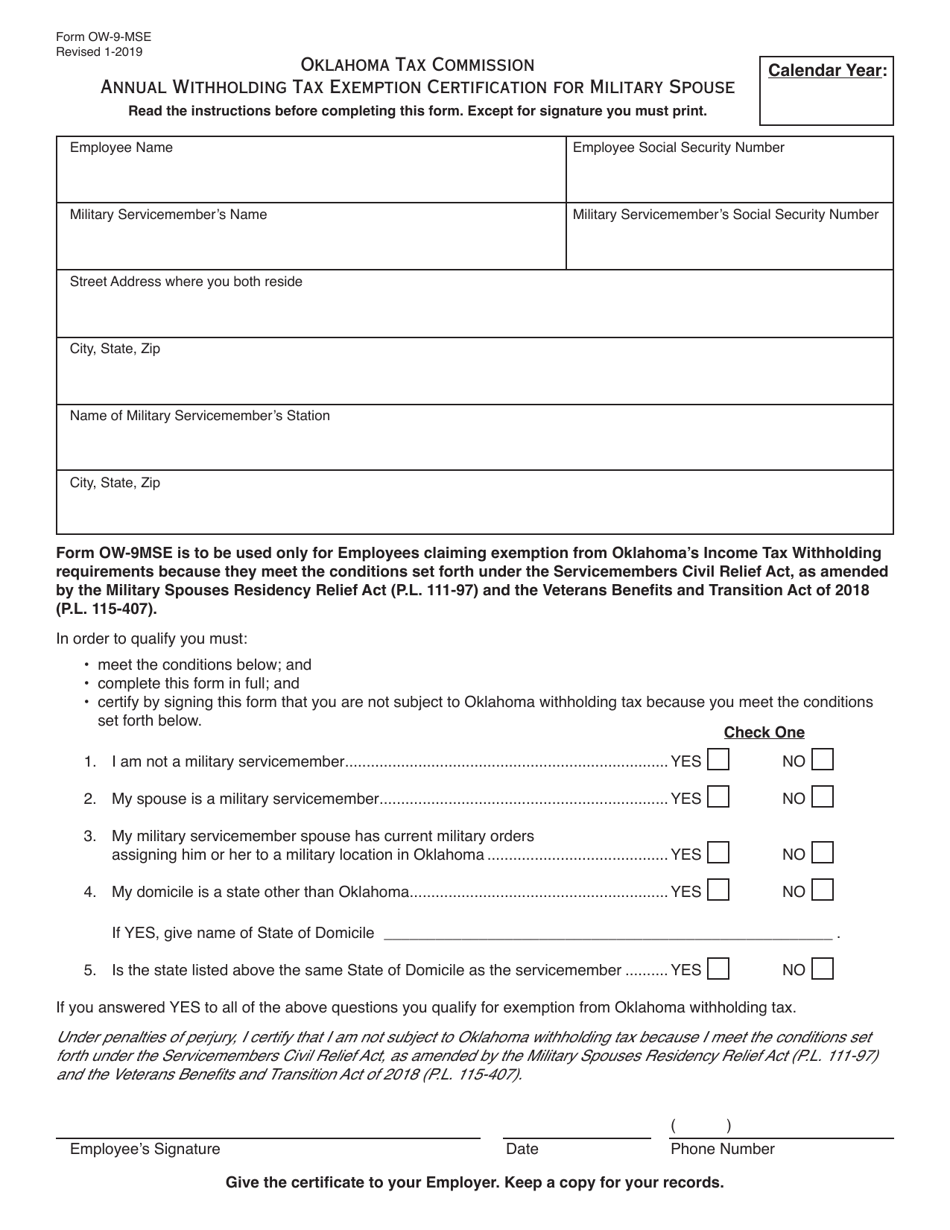

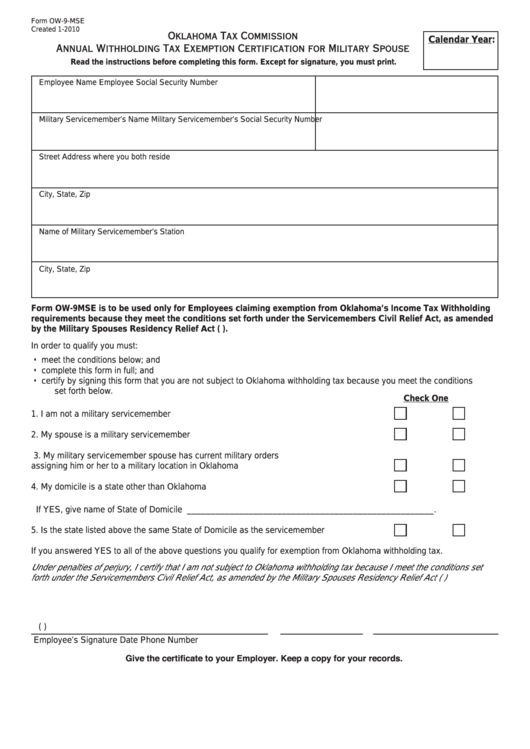

Form OW-9MSE is to be used only for Employees claiming exemption from Oklahomas Income Tax Withholding requirements because they meet the conditions set forth under the Servicemembers Civil Relief Act as amended by the Military Spouses Residency Relief Act PL. However your tax status in that state isnt always the same as your service member spouses status. A spouse making this election will be considered to be domiciled in the same state as the servicemember.

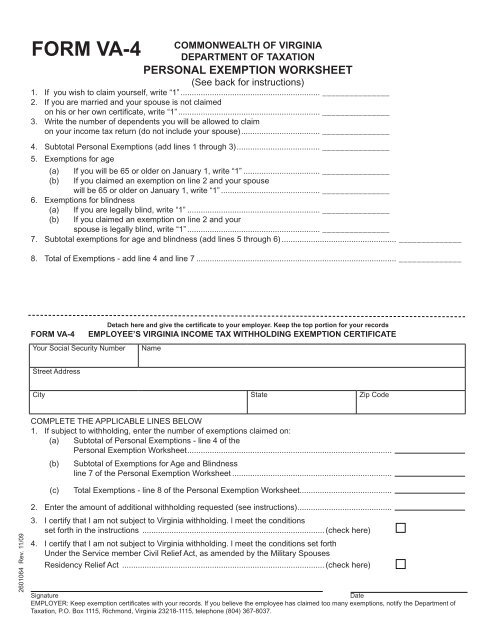

Both spouses in the military and not domiciled in Maryland and one or both have Maryland income Must file a joint nonresident return. I qualify for exemption from Virginia income tax under the Military Spouses Residency Relief Act. The Military Spouses Relief Act was signed into law on November 11 2009 effective for tax years beginning on or after January 1 2009.

What Form Should I File Military Spouse VA During the taxable year were you a military spouse covered under the provisions of the Military Spouse Tax Relief Act whose legal domiciliary residence is Virginia. Military personnel should be aware that there may be provisions for tax credits granted. Federal Military Spouses Residency Relief Act.

The following conditions must be met to qualify under the MSRRA. The Military Spouses Residency Relief Act allows military spouses to declare the same state of legal residency as their spouse. The Military Spouse Residency Relief Act gives you the ability to choose whether to claim the state you are living in or your spouses legal residence for tax purposes.

The Military Spouses Residency Relief Act provides that a civilian spouses domicile does not change based only on the civilian spouses presence in a state to be with the servicemember. Form DD 2058 State of Legal Residence Certificate may need to be filled out according to state requirements. Exemptions and deductions must be adjusted.

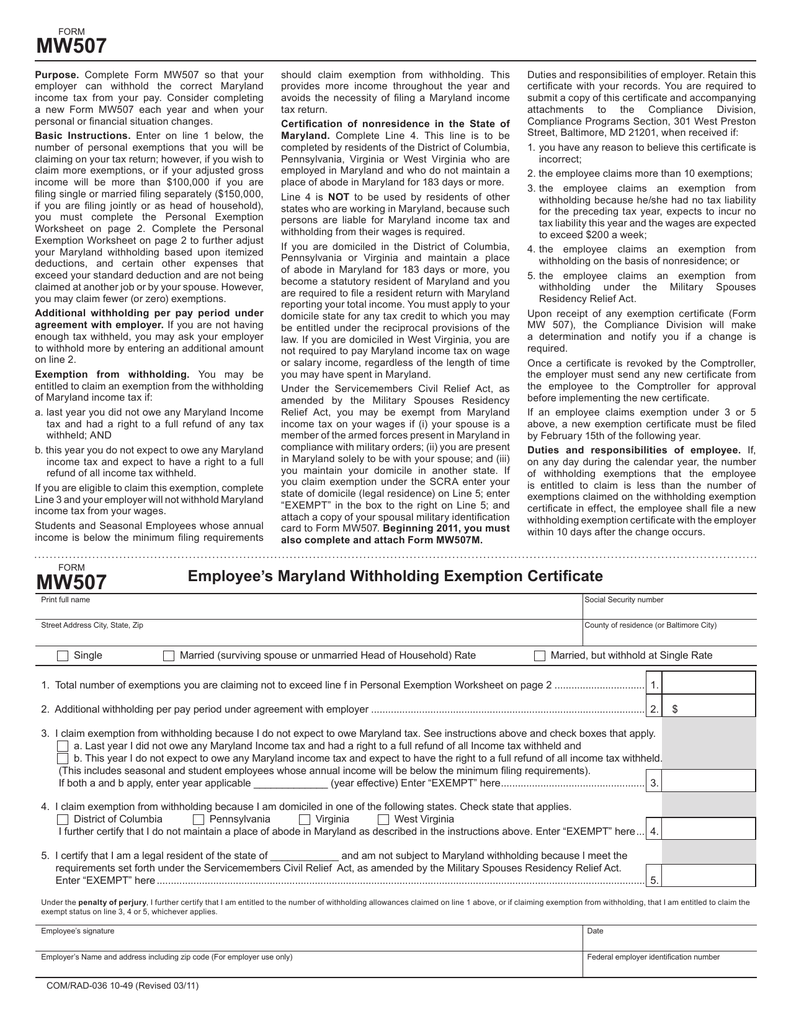

If your spouse is in the military you likely move from state to state. It may affect the state income tax filing requirements for a spouse of an individual in the military. Completing Form MW507M If you meet all of the eligibility requirements for the exemption from withholding fill out lines 1 through 3 of Part 1.

Under the Act the spouse of an individual in the military is a non-resident of a state and consequently not subject to that states taxation if. The Military Spouses Residency Relief Act MSRRA as it was first passed in 2009 allowed military spouses to claim for tax purposes the same state of domicile as their service member as long as. Application of the Military Spouses Residency Relief Act amending the Service members Civil Relief Act.

You must simply be able to prove that you have lived there too. Also a state might exempt military income earned while the service member is out-of-state on military orders. The Military Spouses Residency Relief Act may impact your W-4 form.

Voting A military spouse may vote within their spouses legal state of residence. Military Spouses Residency Relief Act MSRRA Public Law 11197 1. The Military Spouses Residency Relief Act amends the Servicemember Civil Relief Act to include the same privileges to a military servicemembers spouse.

B If a spouse of a service member is entitled to the protection of Military the Spouses Residency Relief Act in another state and they are a tax resident of Georgia and files a withholding exemption form in such other state the spouse is required to submit a Georgia Form G-4 so that withholding occur as is will required by Georgia Law when a Georgia domiciliary works in another state and withholding is not required by such other state. For tax years beginning January 1 2018 the Veterans Benefits and Transition Act of 2018 amended the Servicemembers Civil Relief Act to allow the spouse of a servicemember to elect to use the same residence as the servicemember for state tax purposes. The Veterans Benefits and Transition Act allows that choice to be made regardless of when they were married.

Be sure to complete the questionnaire on the back of the form and attach the documents requested including your W-2s. How do I request a refund of the taxes my employer withheld from my wages. By Alexis Lawrence Updated March 28 2017.

Meet the conditions below. The military spouses residency relief act msrra as it was first passed in 2009 allowed military spouses to claim for tax purposes the same state of domicile as their service member as long as. Military spouses no longer have to file multiple part-year and nonresident income tax returns when they earn wages.

The MSRRA changes the basic rules of taxation with respect to military spouses who earn income from services performed in a State in which the spouse is present with the Service member SM in compliance with military orders when that State is not the spouses domicile legal residence.

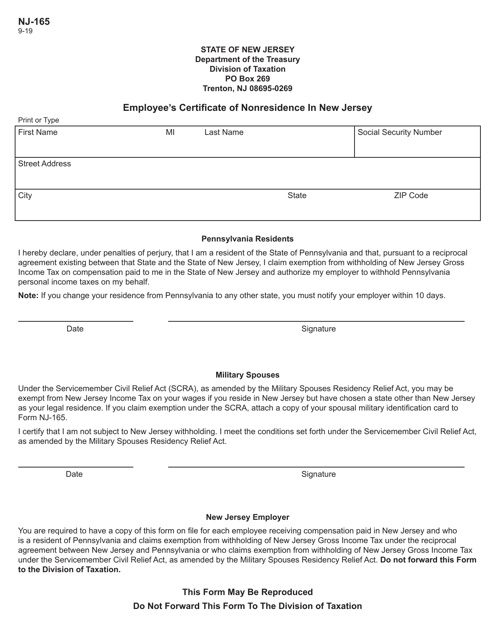

Form Nj 165 Download Fillable Pdf Or Fill Online Employee S Certificate Of Non Residence In New Jersey New Jersey Templateroller

Https Www Chesterfield Gov Documentcenter View 2408 Military Spouses Residency Relief Form Pdf

Military Spouse Act Residency Relief Msrra Military Benefits

Free 10 Sample Tax Exemption Forms In Pdf

Https Www Langston Edu Sites Default Files Basic Content Files Oklahoma 20tax 20commission 20w 4 Pdf

Http Neilgeneralcontractor Com Data Documents Nel General Contractor Employee Application Packet Pdf

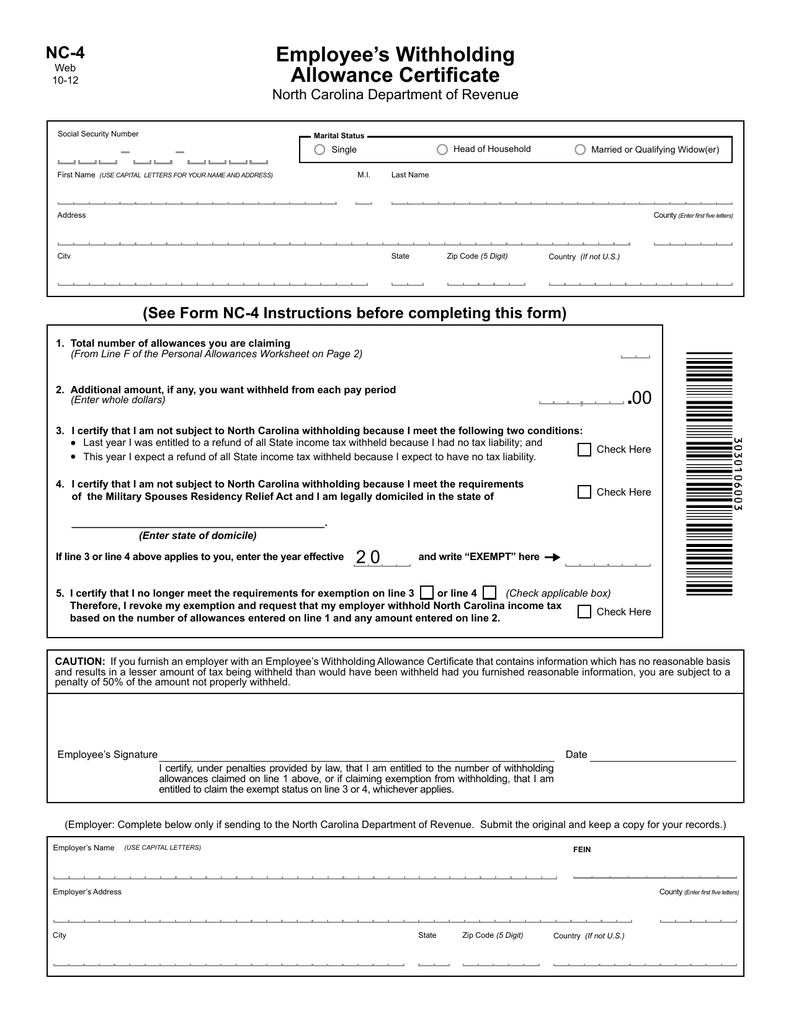

Employee S Withholding Allowance Certificate

Form Rpd 41348 Fillable Military Spouse Withholding Tax Exemption Statement

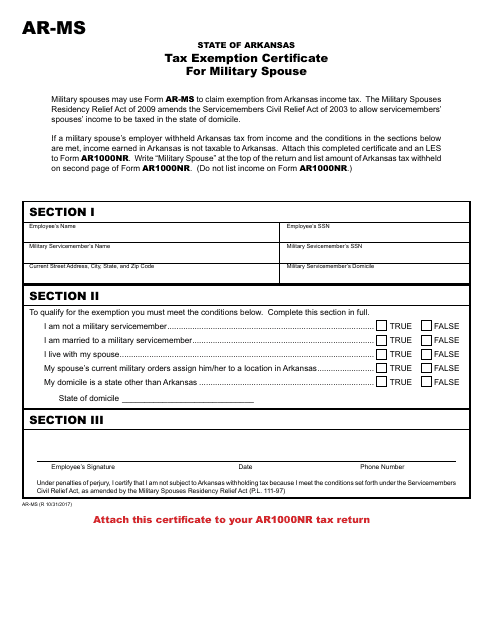

Form Ar Ms Download Printable Pdf Or Fill Online Tax Exemption Certificate For Military Spouse Arkansas Templateroller

Otc Form Ow 9 Mse Download Fillable Pdf Or Fill Online Annual Withholding Tax Exemption Certification For Military Spouse Oklahoma Templateroller

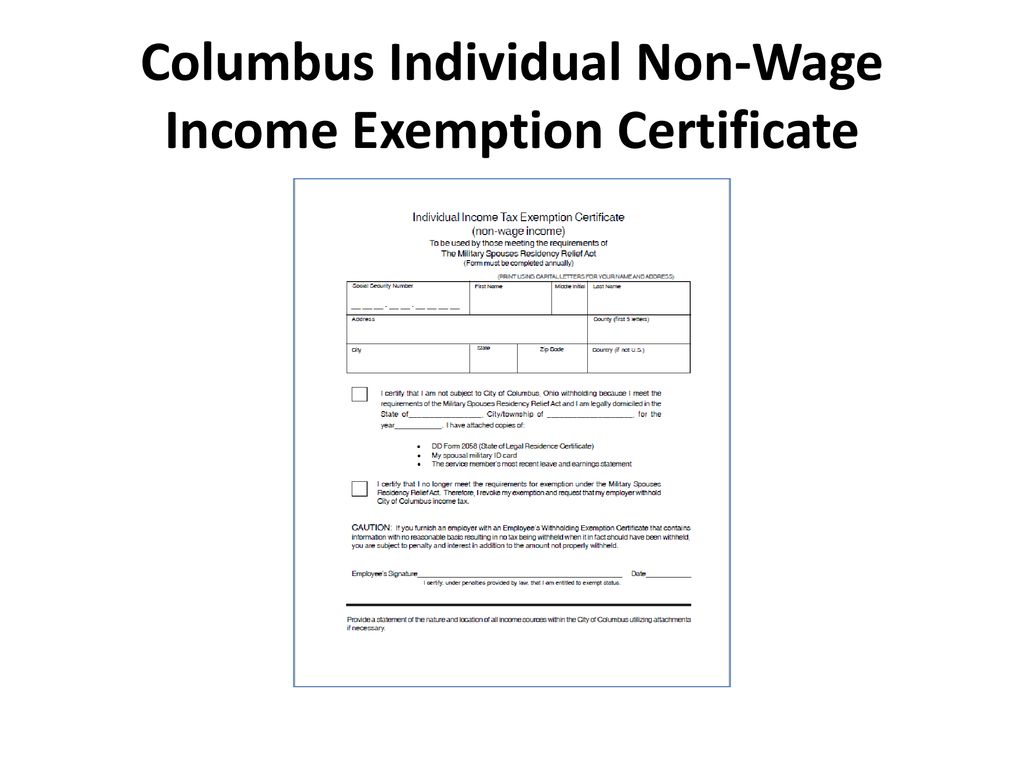

Military Spouse Residency Relief Act Ppt Download

Https Www Columbus Af Mil Portals 39 Documents Other Change 20to 20msrra Pdf Ver 2019 01 31 154619 590

Fillable Form Ow 9 Mse Oklahoma Tax Commission Annual Withholding Tax Exemption Certification For Military Spouse Printable Pdf Download

Https 341fss Com Docs Afrc Military Spouses Residency Relief Act Pdf

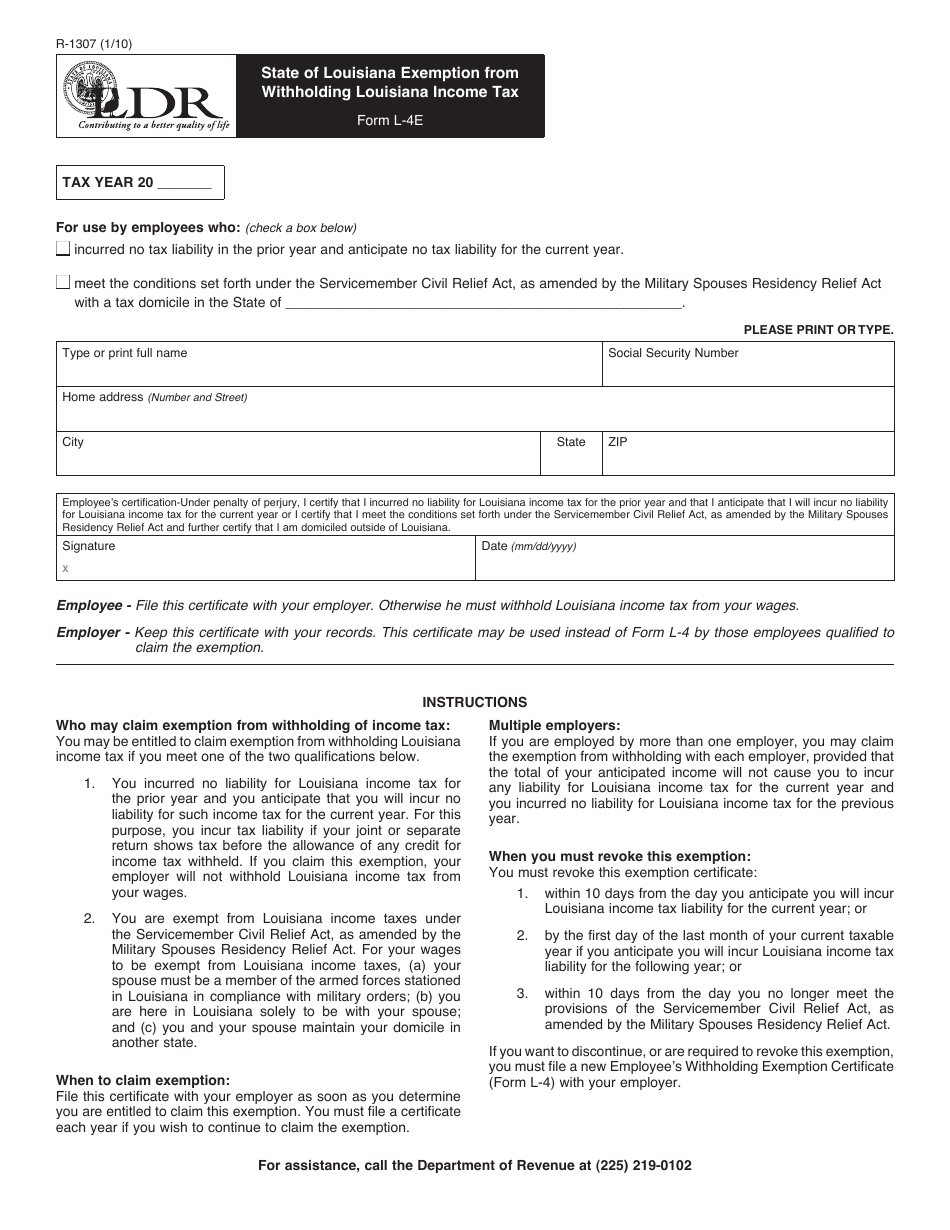

Form R 1307 Download Fillable Pdf Or Fill Online State Of Louisiana Exemption From Withholding Louisiana Income Tax Louisiana Templateroller