When My Husband Dies Will I Get His Social Security Check

dies security whenA divorced spouse may be eligible to collect Social Security benefits based on the former spouses work record. I do not believe this is accurate.

:max_bytes(150000):strip_icc()/GettyImages-157422696-91d9faa2445f43fd95062873356b57bc.jpg)

How To Advise Non U S Citizens On Social Security

You might however qualify for SSI yourself if you are over 65 or disabled and have limited resources and income.

When my husband dies will i get his social security check. If you apply before your survivor full retirement age you will receive between 715 and 99 of your spouses benefit PIA. The marriage must have lasted for at least 10 years and the divorced spouse must be. Generally speaking if you are of retirement age 62 years old you can receive Social Security retirement benefits based on your spouses record with the SSA.

In your case since both of you are over the full retirement age the surviving spouse is eligible for 100 of the benefit that the deceased spouse was getting he said. The government calculates the amount of Social Security you can receive from your deceased spouse based on a few factors. Typically if your spouse passes away Social Security first pays out a one-time death benefit of 255.

The most common mistake concerns deciding when to start taking Social Security benefits. In most cases if your spouse met the income and resources requirements for SSI you will too. If the individual uses direct deposit you must notify the bank of the date of death and complete the form for return of the payment.

A disabled widow or widower aged 50 to 59 would receive 715 of their spouses benefit. If your deceased spouse DID FILE for benefits BEFORE FULL RETIREMENT AGE you are entitled to receive what your spouse was receiving or 825 of your deceased spouses full retirement age benefit. If you receive a Social Security payment after the death of the individual addressed on the check you must return the check to the Social Security Administration.

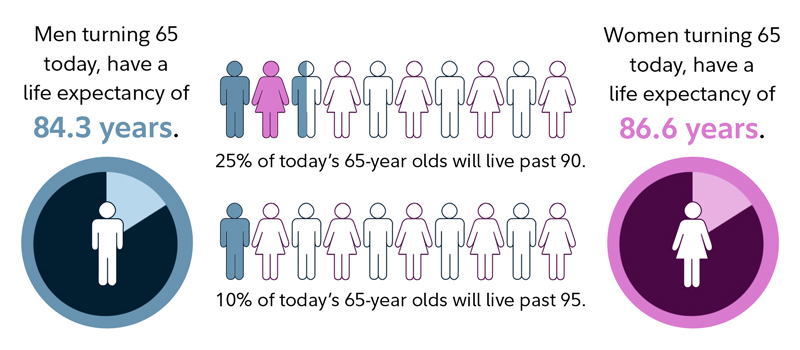

By starting to claim benefits at age 62 youll get a reduced amount compared to what you would receive at your full retirement age. If you are already drawing a small amount from your ex-husbands Social Security you should be eligible to receive a survivor benefit when he passes away. So if your spouse hasnt retired yet your best bet is usually to make sure he or she chooses joint and survivor - or you may be in serious financial jeopardy if your spouse dies before you do.

More on Social Security spousal benefit. You can start taking the benefit at age 62 but then your benefit will be reduced by about a third versus if you take it at full retirement age generally 66 or 67 Lynch said. As long as a divorced spouse.

You may be able to get more Social Security by taking benefits based on your ex-spouses work record instead of. But even if your marriage ended in divorce long ago heres a piece of good news. You recently wrote that a wife could apply for Social Security at 62 and then switch later to her spousal benefit.

If your spouse was receiving Supplemental Security Income SSI you will not be able to continue receiving his SSI payments. Yes your spousal Social Security benefits you currently receive will convert to survivor benefits at the time of your ex-husbands death according to David Cechanowicz director of education. However the survivor will.

My husband died 11621 he had received his social security check by direct deposit for Decon 12021 Why - Answered by a verified Social Security Expert We use cookies to give you the best possible experience on our website. A one-time lump-sum death payment of 255 can be paid to the surviving spouse if he or she was living with the deceased. If youre at least 60 but not yet at Social Securitys definition of full retirement age your payout will be somewhere in the range of 71 to 99 of your deceased spouses full benefit.

The Primary Insurance Amount PIA is the number Social Security uses to determine survivor benefits. In some cases you may be able to receive disability benefits based upon his or her earnings if youre also disabled. If you take it at.

Or if living apart was receiving certain Social Security benefits on the deceaseds record. If you can wait until age 70 to claim Social Security you and your spouse will benefit from the delayed retirement credits. After that you can activate the Social Security survivor benefits.

Guide To Social Security Death Benefits Simplywise

Do I Have To Provide My Social Security Number Mortgage Questions

Can I Switch From My Social Security Benefit To My Spousal Benefit Simplywise

What To Do When A Social Security Beneficiary Dies

Social Security Benefits For Divorced Spouses Simplywise

Collecting Survivor Benefits From Your Ex Spouse

Can I Collect Social Security From My Ex Spouse

Social Security Retirement For You Your Spouse And Your Kids Social Security Benefits Social Security Retirement

Social Security Surviving Divorced Spouse Benefits Benefits Gov

How To Report A Death To Social Security

/GettyImages-149357059-b06074af5ea4494aba83d73a3755f261.jpg)

How Do I Calculate My Social Security Break Even Age

Everything You Need To Know About Social Security Retirement Benefits Simplywise

If My Spouse Dies Do I Get His Social Security And Mine Simplywise

Social Security For Divorced Spouses Fidelity

Here S What Happens With Social Security Payments When Someone Dies

:max_bytes(150000):strip_icc()/GettyImages-186861940-abd89d6730bc4396a41b98a1fa546d34.jpg)

How Social Security Works After Retirement

You May Qualify For Social Security Spousal Benefits From Your Husband Or Wife Even If You Re Divorced But Wh Social Security Social Security Benefits Social