Garnishing Va Disability Benefits

benefits garnishing wallpaperHowever your VA disability compensation cannot be garnished at all unless you waived part of your military retired pay in order to receive VA disability benefits. To prevent creditors from garnishing bank accounts Congress requires any credit agency trying to freeze a Veterans VA disability benefits to follow certain legal procedures.

Can Va Disability Benefits Be Garnished Cck Law

Understanding when your VA disability pension or retirement payment is under legal protection is vital to safeguarding your money.

Garnishing va disability benefits. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Some benefits such as Supplemental Security Income SSI are protected from garnishment even to pay a government debt or child or spousal support. If the veteran has multiple children to support equal payments will be provided to each child out of garnishment.

If the former spouse is living with or married to another person. Creditor Claims on Your VA Benefits Garnishment of Bank Accounts. So if your bank receives a garnishment order for you and your Veterans Affairs benefits are directly deposited they should be protected.

If the veterans former spouse or child has not filed for apportionment. Child Support and Alimony. However the key phrase is most cases because federal and state laws do not protect all types of VA benefits from every garnishment scenario.

Garnishment is the process by which money is seized from an individual in order to satisfy a debt that is owed. You may qualify for VA disability benefits for physical conditions like a chronic illness or injury and mental health conditions like PTSD that. But any money in the account in excess of two months of.

If you are the beneficiary of a disability claim such as SSI SSDI Veterans disability pensions or any other type of disability payment that is paid to you by the Federal government or an employer you should know that your monthly benefits are considered garnishment exceptions. If the former spouse was found by state court to have. Social Security and Social Security Disability Insurance SSDI can sometimes be garnished to pay certain government debts such as back taxes or federal student loans and debts for child or spousal support.

Typically between 20 to 50 percent of VA disability benefits can be garnished as 20 percent is considered to be an insufficient amount for a veterans dependents and 50 percent is considered to cause undue hardship to a veteran. Essentially a debt collector must verify that no VA benefits have been deposited in the bank in the last two months. For regular income a creditor can get a court order to take money from your bank account.

The short answer is yes. Veterans benefits are considered to be protected income and as such exempt from a garnishment order in most cases. Garnishment to a former spouse would be denied if.

There are certain circumstances in which VA disability benefits can be garnished. In other words if you waived part of your taxable military retirement to receive nontaxable disability compensation your disability benefits can be garnished to meet alimony and child support obligations. Specifically if a veteran fails to make alimony and child support payments the state can sometimes order their VA benefits to be garnished.

Thus the Veteran has protection for at least two. On the flip side your compensation cannot be garnished if you choose to waive a portion of your military retirement pay. Federal law protects your VA benefits from being garnished to pay regular creditors claims.

The VA can garnish your benefits according to Title 38 which states that you must be able to support your dependents. The garnishment was to cause undue financial hardship. The federal benefits that are exempt from garnishment include.

Social Security Benefits Supplemental Security Income SSI Benefits Veterans Benefits Civil Service and Federal Retirement and Disability Benefits Military Annuities and Survivors Benefits Student Assistance Railroad Retirement.

Can Va Disability Compensation Be Used To Calculate Child Support Or Income Legalzoom Com

Can My Social Security Disability Benefits Be Garnished Dr Bill Latour

Can Social Security Disability Ssi Benefits Be Garnished Virginia Social Security Disability Special Needs Planning Attorney

Can Your Va Disability Be Garnished Hill Ponton P A

Veteran Disability Claims Frequently Asked Questions Rob Levine

Va Disability In A Divorce Military Divorce Guide

Va Disability Benefits Divorce And Child Support Cck Law

Garnishing Veteran Benefits For Child Support The Child Support Hustle

Louisiana Garnishes Veteran Disability Benefits Loyd J Bourgeois Llc

Is A Divorced Spouse Entitled To Va Disability Benefits Va Claims Insider

When And If Va Can Stop A Veteran S Disability Benefits Cck Law

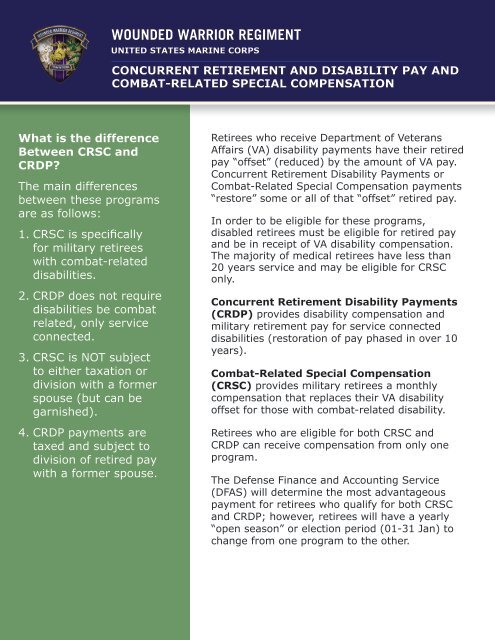

What Is The Difference Between Crsc And Crdp United States

Garnishment Of Military Pay Retirement Military Divorce Guide

Can Va Disability Benefits Be Applied For Child Support

Https Texaslawhelp Org File 581 Download Token Imyt8yot

Can Your Va Disability Benefits Be Garnished For Child Support Call Now

Va Disability Legal Resources Hill Ponton P A