Military Divorce Retirement Pay Formula

divorce military wallpaperIf the court chooses to award the members spouse 50 of the marital share the spouse will receive 40 of the service members disposable retired pay. Service Member was injured while service and only served 4 years-the.

Military Divorce How Your Military Pay Might Be Affected

12 years of marriage20 years of service X 05 X 100 30 If the state court follows this standard formula your former.

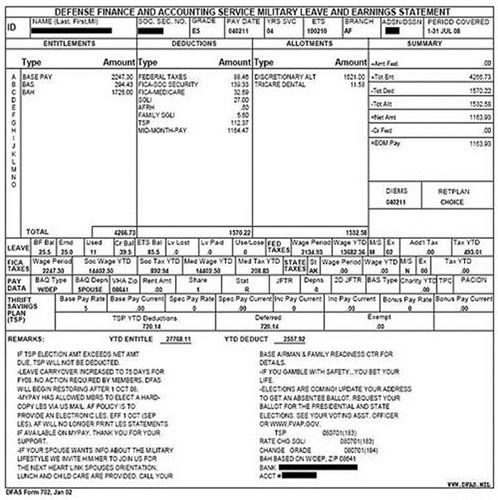

Military divorce retirement pay formula. If the marriage did not last 10 years then the service member has to execute a Form 2558 with DFAS which will order an allotment to be paid to the former spouse directly. This is a rough estimate. A service members military retired pay can be a valuable asset in a divorce legal separation or dissolution of marriage.

Under the former rule in Colorado the marital share of the retirement would be 5 years of marriage overlapping 28 years of service or 1786 and the former spouses share is half of that or 89. For example it would be perfectly legal for a court to divide military retired pay 5050 for a marriage that only lasted two months again subject to the laws of that state. Note that your spouse would not be eligible to receive this portion fo you leave the military before you reach retirement age.

16 divided by 20 80. This can be illustrated as. An entitlement based on pay at retirement.

Reserve duty is calculated differently. The basic formula for determining ones retired pay is Retired Pay Base times Retired Pay Multiplier or RPB X RPM. It requires that retired pay be established or frozen based on the members rank and years of service at the time the court order dividing military retired pay typically the final divorce decree is entered.

Assuming a 25 annual multiplier the members retirement would be 28 x 0025 x 6800 or 4760. Martial money is split down the middle. The military retirement pension formula is.

Service multiple comes from the number of years of service or Reserve drill points two different formulas. Marital Asset disposable retired pay x marital duty monthstotal duty months x pay at divorcepay at retirement Former Spouse Benefit ½ x marital asset assuming equal division. The military will pay your spouse hisher part of the service members military retirement directly if the marriage lasted 10 years or longer.

Active duty formula The former spouse is awarded a percentage of the members disposable military retired pay to be computed by multiplying 50 times a fraction the numerator of which is x months of marriage before separation during the members creditable military service divided by the members total number of months of creditable military service. Our Virginia Military Retirement Divorce Calculator assumes that your military time was served while on active duty and not reserve duty. That is considered marital money that belongs to both parties.

Pension service multiple x pay base. So out of that 3000 a month 2000 a month belongs to the marriage. The marital share of the service members disposable retired pay would be 80.

First it authorizes but does not require State courts to divide military retired pay as a marital asset or as community property in a divorce proceeding. The most common formula for calculating and dividing military retirement pay that has not yet matured is the Coverture Fraction Formula which simply divides the number of years of service during marriage by the total number of years of service at the time the military spouse would retire. In 1982 Congress passed the Uniformed Services Former Spouse Protection.

In the event that you all get a divorce your spouse would be eligible to receive 25 of your disposable military retirement pay. The former spouse would receive 1000 dollars a month and the military member would receive 1000 dollars a month for the marital money. When the couple divorced in 2018 Pat was a Captain who hoped to make Major in the next two years.

50 of multiplied by 80 40. The most Sam can be awarded by the divorce court from Pats military retired pay is 50 of the calculated disposable retirement for a Captain with 8 years of service. The usual percentage is 25 but its 20 when a the servicemember elected to receive a mid-career cash bonus known as CSBRedux or when b the member is in the Blended Retirement System.

Instead of allowing the states to decide how to divide military retired pay and what formula or methodology to use Congress imposed a single uniform method of pension division on all the states a hypothetical scenario in which the military member retires on the date of divorce. The freeze time rule computation requires an additional coverture fraction to calculate the spousal benefit. A state could also decide to award a majority of the retired pay to the former spouse if the state laws allowed such a division.

The Uniformed Services Former Spouses Protection Act USFSPA Title 10 United States Code Section 1408 passed in 1981 accomplishes two things. In this readers case the divorce decree splits the pension 50 to each and the Reserve retirement starts later in 2013 the current pay table. Based on changes in Virginia Law this calculator will provide the best estimate if you were off active duty prior to 2018.

A service member may be eligible for disability pay but may not be eligible for a pension. Twelve 12 years of your marriage overlapped with the military service. Sam may also get Cost of Living Adjustments COLA for their portion.

Military Retirement Pay Va Org

Double Bonus Military Retirees Can Receive Retirement And Va Disability Benefits Hill Ponton P A

How Much Is Military Retirement Worth Calculate Present Value Of Retirement Pay

Jurisdiction To Divide Military Retirement Military Divorce Guide

Dividing Military Retirement Pay During Divorce Arizona Stewart Law Group

Military Pension Division And The Frozen Benefit Rule Nuts And Bolts North Carolina State Bar Legal Assistance For Military Personnel

Calculate Child Support Payments Child Support Calculator Parental Income Influences Child Support Child Support Quotes Child Support Payments Child Support

Military Retirement Pay Pension Benefits Explained

Calculation Of Military Retirement Pay Shares Military Divorce Guide

Https Www Hqmc Marines Mil Portals 135 Docs Jal Family 20law Foreign 20marriages 20and 20divorces Divorce And Division Of Retirement Pay Pdf Ver 2017 06 09 120340 100

Financial Literacy Month Financial Literacy Financial Literacy Lessons Financial Motivation

How To Calculate The Value Of A Guard Reserve Retirement Military Guide

Garnishment Of Military Pay Retirement Military Divorce Guide

Military Divorce In Texas Cook Cook Law Firm Pllc

Pin On Naggiar Sarif Family Law Llc

/GettyImages-639517721-82dc021f743a4b1082375f8e7c34c459.jpg)

How Is Military Retirement Pay Divided During Divorce

Guide Military Retirement During Divorce Cook Cook Law Firm Pllc