Exchange Rate System Under Imf Is Known As

exchange wallpaperUnder fixed exchange rate system the currency rate in the market is maintained through. Under the rules of IMF an exchange rate system known as Bretton Woods System was evolved.

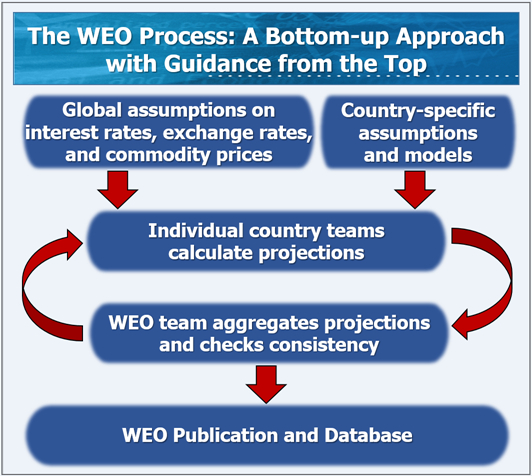

World Economic Outlook Frequently Asked Questions

World Economic Outlook Frequently Asked Questions

B setting the fixedparity exchange rate.

Exchange rate system under imf is known as. When foreign exchange market forces determines the relative value of a currency Inflow-Outflow the country is adhering to a floating. International monetary system C. Member nations including Germany France the Netherlands.

Under the IMF system the monetary authority of a member nation fixes the official value of its currency in terms of a reserve currency usually the US dollar or a basket of key currencies The. Original Scheme Under IMF. The Fixed Exchange Rate System proposed by them was implemented in 1946.

The main purpose of the IMF was to monitor the international fixed exchange rate system and to provide temporary loans to countries suffering balance of payments problems. International Monetary Fund IMF International Bank of Reconstruction and Development IBRD which is also known as World Bank The IMF was given the mandate to establish a suitable exchange rate system. The Thai government amended its monetary policies to be more in line with the new IMF policy.

Since the breakup of the Bretton Woods fixed exchange rate system in 1973 the IMF has mostly assisted countries by making structural adjustment loans to those that have difficulty repaying international debts. The Bretton Woods system of internationally fixed exchange rates was born out of the conference as was the International Monetary Fund IMF and the World Bank. The Bretton Woods System collapsed in the 1970s but created a lasting influence on.

It had been thought that the fixed exchange rates system would be beneficial for the development and functioning of international trade. After reading this article you will learn about the various exchange rate systems under International Monetary Fund IMF. The floating category consists of managed float and independent float the latter.

In March 1990 a new exchange rate system known as the market average rate system replaced the former multicurrency basket peg system. The Bretton Woods System required a currency peg to the US. The new system of exchange rates required the member countries to fix the parities of their currencies in terms of US or gold.

The IMF is governed by and accountable to its 190 member countries. As decided in the Bretton Woods Conference the International Monetary Fund IMF was established in 1946. As a reminder the classification of exchange rate systems used in Figure 1 and in my previous paper is that of the staff of the IMF based on their evaluation of the de facto exchange rate arrangement in place at the time.

4 Under a fixed exchange rate regime the government of the country is officially responsible for A intervention in the foreign exchange markets using gold and reserves. Ref INTERNATIONAL BUSINESS by JUSTIN PAUL Floating Rate System was formalized in 1976 by IMF when IMF members met in Jamaica. Dollar which was in turn pegged to the price of gold.

Due to the introduction of a new generalized floating exchange rate system by the International Monetary Fund IMF in 1978 that gave a smaller role to gold in the international monetary system this fixed parity system as a monetary co-operation policy was terminated. During the 1980s and 1990s the Exchange Rate Mechanism of the European Monetary System was a system of simultaneous bilateral commitments to maintain. The European exchange rate mechanism ERM was established in 1979 as a precursor to monetary union and the introduction of the euro.

3 Table 1 lists the categories of exchange rate regimes with the intermediate grouping consisting of varieties of less than very hard pegs include crawling pegs and bands. Under this system the basic exchange rate of the Korean won against the US. Under a pegged exchange rate regime a country will peg the value of its currencyto ADomestic inflation rate.

International monetary fund. The scheme ranks exchange rate arrangements on the basis of their degree of flexibility and the existence of formal or informal commitments to exchange rate paths. INTERNATIONAL MONETARY FUND Published Date.

Current regulations of IMF ANSWER. It also facilitates international trade promotes employment and sustainable economic growth and helps to reduce global poverty. Dollar was determined in the market within a specified range around the weighted average interbank rates of the previous day.

Fixed exchange rate system D. As was the case with rates generally under the Bretton Woods System before its breakdown and as some countries choose to do now. According to classification by IMF the currency system of India falls under A.

Countries got monetary Policy Autonomy under Floating Rate System. This classification system is based on members actual de facto arrangements as identified by IMF staff which may differ from their officially announced arrangements. Pegged to basked of currencies ANSWER.

In the Great Depression that preceded World War II most countries had abandoned the gold standard. The International Monetary Fund or IMF promotes international financial stability and monetary cooperation. After the end of World War II to facilitate the smooth international trade to improve the standard of livings of citizens of the globe The International Monetary Fund was incorporated.

A managed float is also known as a AFixed exchange rate system BFloating exchange rate system.