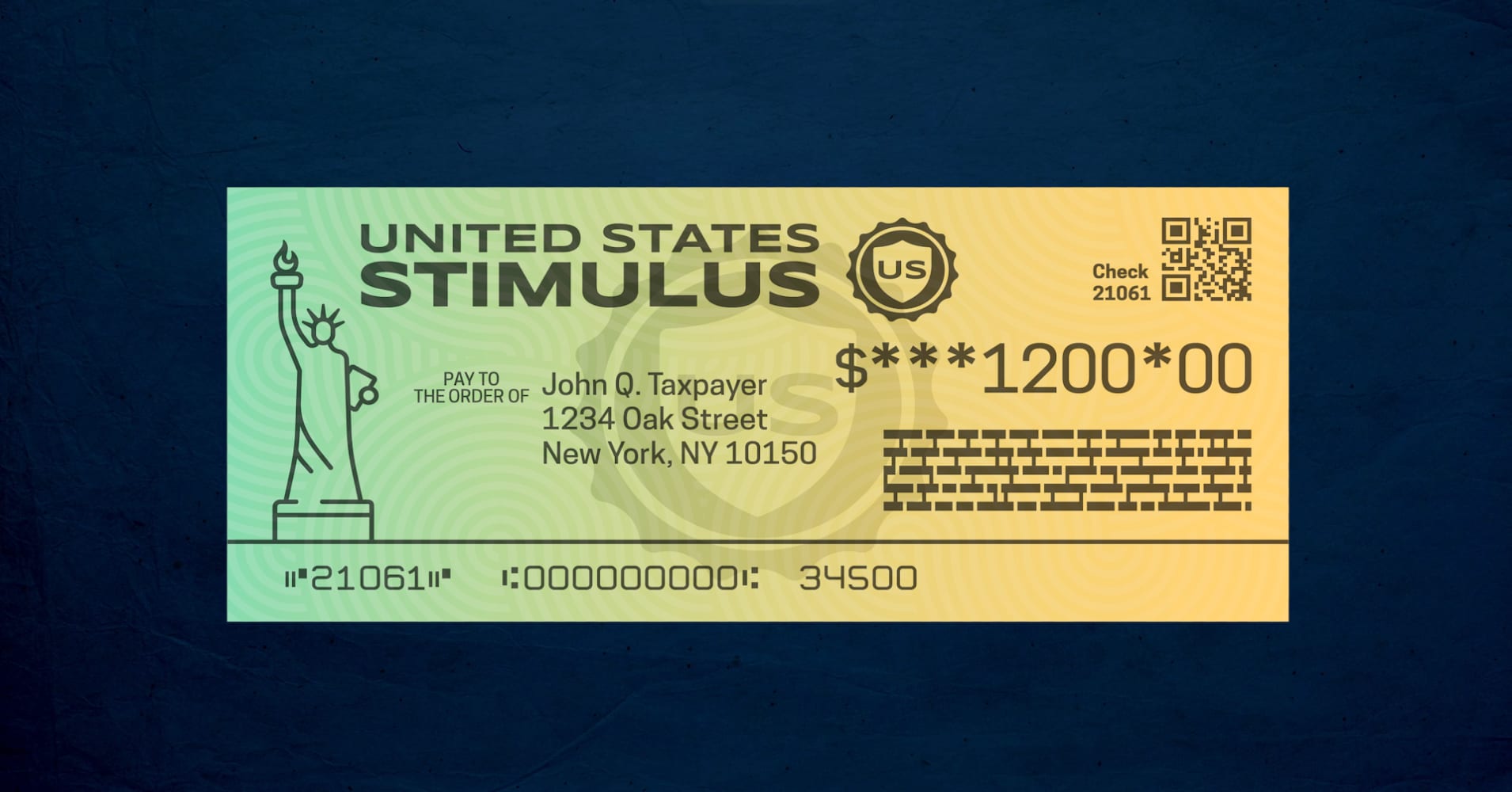

My Wife Received A Stimulus Check But I Didn't

stimulus wifeIts possible the IRS made. Chances are that youve already received notification about your second round of stimulus checks.

Have A Second Stimulus Check Or One On The Way Your Rights May Change Cnet

600 for her and 600 for one child.

My wife received a stimulus check but i didn't. The first check came as a paper check and not direct deposit not sure why but at least we got it. If youre a Social Security beneficiary with a foreign address whose monthly benefit is deposited into a foreign bank account youll receive your stimulus payment as a check in the mail. You can now call the IRS hotline at 1-800-919-9835 to get updates on your stimulus check payment.

Wouldnt they put all the money into her account or mine 2400 instead. She had a different bank than me - and I have Wells Fargo. We filed jointly about 2 weeks ago but separate in 2018 and I did not file that year.

We have been on SSID for the last 4 years and receive auto deposit in our accounts every month. Youre not alone -- millions of eligible people never received one or both of their stimulus payments in the mail or didnt get the full amount they were qualified for. We received the first stimulus in the full amount back in May via DD with no problem.

No bank or address info has changed since. We have two dependents. Not everyone has received their stimulus payment yet and others received amounts different from what they were expecting.

We received the second stimulus debit card today in my wifes name and only for 600. The second check is the issue here. I cannot understand why we did not get 1200.

Getty The IRS has launched a phone hotline where you can receive updates on your stimulus check. She received her check tonight in her bank account but I did not. The specifics of your case could reveal the answer.

We file a joint return every year and were below the maximum earnings threshold for a full stimulus payment. I want to know why my second payment day direct deposit for a bank I didnt put down or never had Shirley Therriault on January 8th 2021 1024 am Have not received stimulus check. If you didnt get your second stimulus check this way but want to receive a future third stimulus check through direct deposit youll want to register with the IRS on your 2020 tax return.

Wife received a stimulus but I didnt. This batch of checks is being issued much more quickly than the first round from 2020. My status is still showing unavailable on GMP.

So my wife and I are married filed jointly. Is this normal. If you received a letter confirming your first or second stimulus payment but not the money its time to contact the IRS.

Taxpayers will see unclaimed stimulus funds referred to as the Recovery Rebate Credit on Form 1040 or Form 1040-SR of their taxes. Received first stimulus without issues. My husband and I both received the first stimulus check without issue.

Individuals and married couples filing jointly can also claim the. The IRS protocol is to send the letter 15 days after issuing the payment. She received a check via mail for 1200 shortly after the 6th.