Are Va Loan Rates Higher Than Conventional

higher loan thanVA loans tend to have lower interest rates and if rates drop refinancing is far easier than with a conventional loan. Department of Veterans Affairs in any way.

What Is Va Loan An Overview Of Va Home Loan 2019 Conventional Loan Va Mortgage Loans Va Loan Process

What Is Va Loan An Overview Of Va Home Loan 2019 Conventional Loan Va Mortgage Loans Va Loan Process

VA loans are better than conventional loans in a number of ways but well cover the three main ways in this article.

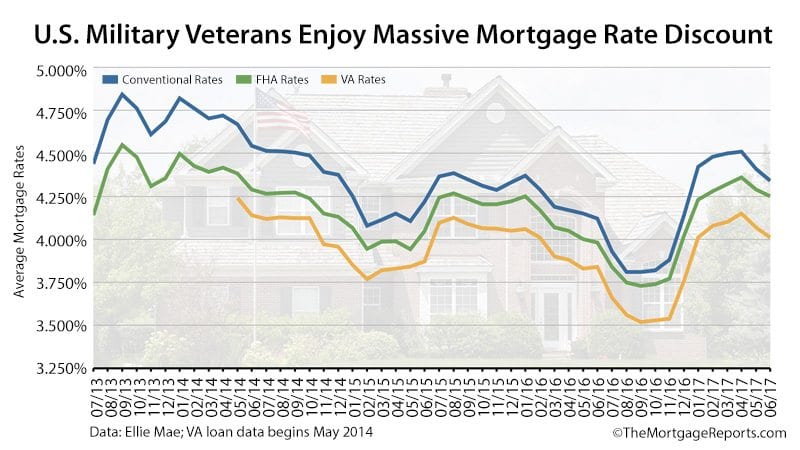

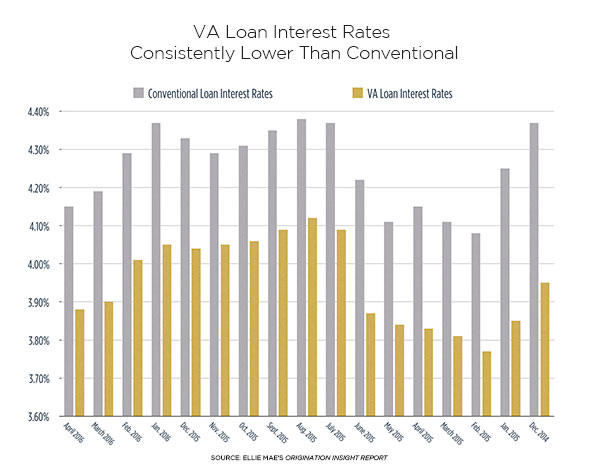

Are va loan rates higher than conventional. How Has VA Loan Rates Graph Changed Over Years. The VA loan program is far superior to conventional loans and it is definitely worth it to use a VA loan instead of a conventional if you are eligible. VA loans usually have an interest rate one-eighth to one-fourth percent lower than conventional says James James Campbell a real estate agent in Los Angeles.

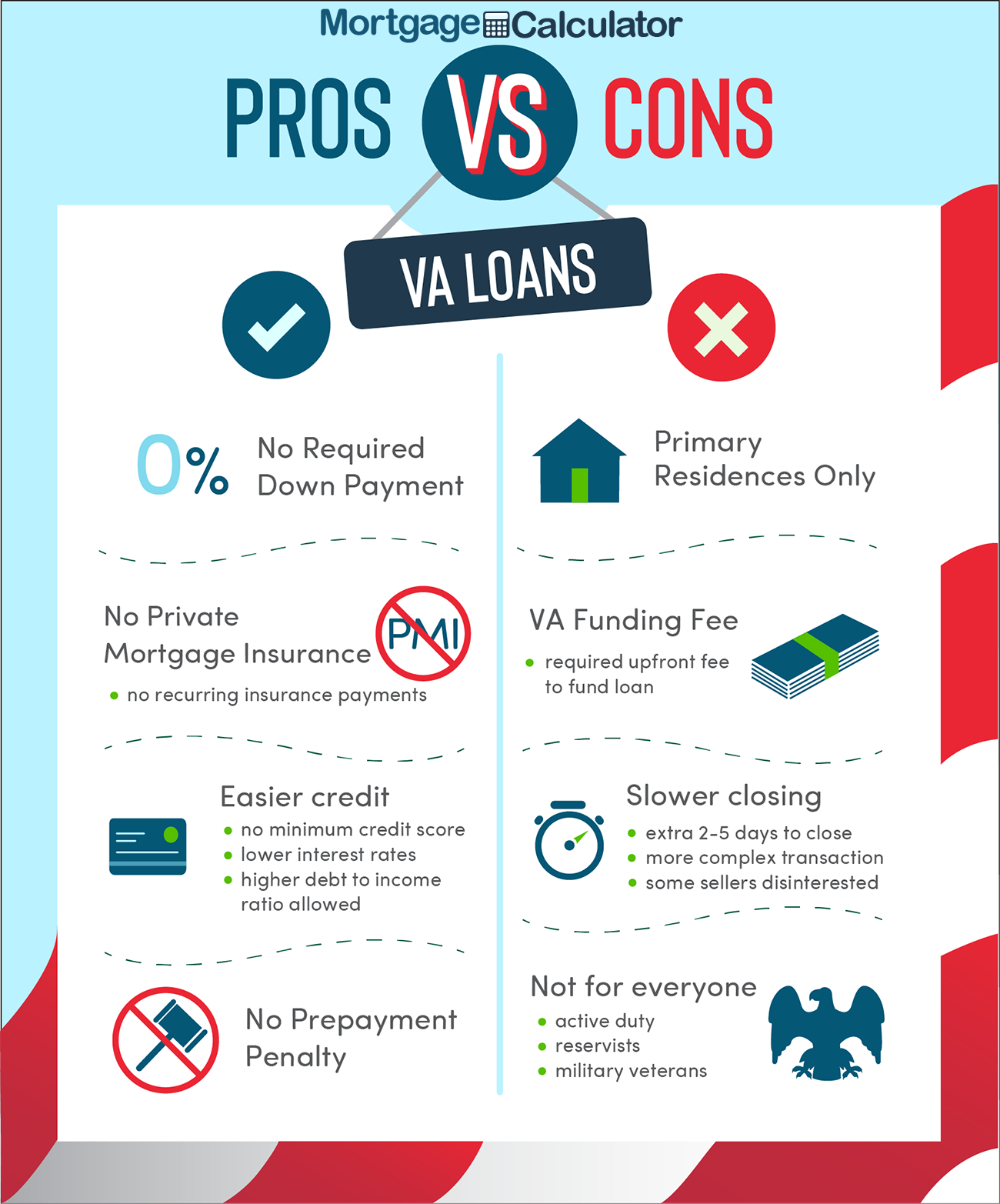

One big drawback to VA loans is the VA funding fee that you have to pay upfront. VA Loans are Easier to Qualify For. Not everyone refinancing a mortgage is.

The Rule of Thumb Generally speaking the rule of thumb is that you can expect interest rate offers between 05 and 10 lower on a VA loan than on a conventional though you likely wont see that big of a difference until interest rates are generally higher than they are currently. VA loans are backed by the Department of Veterans Affairs giving lenders the confidence to extend more favorable rates to borrowers who may not have perfect credit. VA loans require no appraisal no credit review and it can be done with no money out of pocket during closing.

As an eligible veteran you are entitled to a VA loan which is a better choice than FHA USDA or Conventional in most cases. Those are big sums that VA borrowers dont have to worry about. These and many other major advantages are extended to our nations finest for their faithful service.

It likely will have a lower interest rate than a conventional loan. VA loans offer lower interest rates than conventional products which means VA buyers can save money in interest over the life of the loan. If you plan on staying in the home forever this could make or break the deal.

According to the mortgage origination software firm Ellie Mae through Q3 of 2019 VA loans have had the lowest average rates at 427 percent compared to conventional at 45 percent. First because your rate is unique to you. For 30-year fixed-rate loans closing in November 2020 VA loans had an average rate of 272 compared.

Another plus for the VA. FHA loans are eligible for streamline refinances which is a cheaper and quicker way to refinance your loan in a low interest rate period. This difference exists primarily because of the VA guarantee.

The VA Home Loan is the clear winner. The process can be simple and stress free with the help of a VA home loan specialist. If you have a 20 down payment or 20 equity when refinancing you can avoid.

VA FHA USDA or Conventional. Both conventional loans and FHA loans have mortgage insurance premiums but for a conventional loan paying them is only a requirement if the borrower is putting down less than 20 percent. At a glance conventional loan rates look higher than FHA USDA or VA.

FHA loans also have some nice features that conventional do not. Conventional 15-year rates Lower rates than 30-year conventional loans and much lower total interest payments. The housing ratio or the ratio of housing costs to borrower income can also be higher than the 28 conventional loan standard up to 31 in most cases.

On a 200000 loan thats a 10000 down payment for conventional and 7000 for FHA. See our VA loan benefits page for a comparison of these loan types. To offset those losses a new 05 fee -- called the adverse market fee-- was applied to conventional loan mortgage refinancing beginning Dec.

FHA loans are normally priced lower than comparable conventional loans. But on average VA loan rates are actually lower than most conventional mortgages. When you compare the average 30-year VA loan to a 30-year conventional loan youll see that VA loans tend to be between 25 42 points lower than conventional mortgages.

VA loans also do not require down payments which can be an. FHA loan rates are usually the same or lower than conventional mortgages. Of course interest rates vary by lender.

At first glance this may not seem like a big difference but it can save home buyers. But advertised rates shouldnt be taken at face value. Conventional loans typically feature a minimum 5 percent down payment.

For FHA loans its 35 percent. The three ways a VA loan is superior are that a VA loan is easier to qualify for allows you to get better terms and is more friendly to people in tight financial situations. But they tend to be a little higher than those for VA and USDA loans.

Va Loans Fha Loans Refinance Loans Fha Loans Mortgage Loans

Va Loans Fha Loans Refinance Loans Fha Loans Mortgage Loans

Kentucky First Time Home Buyer Loan Programs For Fha Va Khc And Usda Mortgage Loans In Kentucky Mortgage Loans Fha Loans Credit Score

Kentucky First Time Home Buyer Loan Programs For Fha Va Khc And Usda Mortgage Loans In Kentucky Mortgage Loans Fha Loans Credit Score

Va Mortgage Rates Are The Lowest So Why Aren T Veterans Using Them

Va Mortgage Rates Are The Lowest So Why Aren T Veterans Using Them

Are Va Loan Rates And Costs Lower Military Com

Are Va Loan Rates And Costs Lower Military Com

Buying Your First Home Loan Application Checklist Png Kentucky Fha Va Usda Rural Housing Khc And Fann Refinance Mortgage Mortgage Lenders Mortgage Loans

Buying Your First Home Loan Application Checklist Png Kentucky Fha Va Usda Rural Housing Khc And Fann Refinance Mortgage Mortgage Lenders Mortgage Loans

Comparison Of Common Loan Programs Conventional Fha And Va Loans Closedis Va Home Loan Watch This Refinance Loans Conventional Loan Refinance Mortgage

Comparison Of Common Loan Programs Conventional Fha And Va Loans Closedis Va Home Loan Watch This Refinance Loans Conventional Loan Refinance Mortgage

Homeready Mortgage Updated Rates Loan Guidelines Mortgage Current Mortgage Rates Loan

Homeready Mortgage Updated Rates Loan Guidelines Mortgage Current Mortgage Rates Loan

What Is The Minimum Credit Score I Need To Qualify For A Kentucky Fha Va Usda And Khc Conventiona Mortgage Loans Conventional Mortgage Mortgage Loan Calculator

What Is The Minimum Credit Score I Need To Qualify For A Kentucky Fha Va Usda And Khc Conventiona Mortgage Loans Conventional Mortgage Mortgage Loan Calculator

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Mortgage Loans

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Mortgage Loans

Va Home Loan Rates Guidelines Eligibility Requirement For Va Loans Lock In Low Mortgage Rates

Va Home Loan Rates Guidelines Eligibility Requirement For Va Loans Lock In Low Mortgage Rates

8 Great Questions To Ask Your Lender Click To My Blog To See Even More Great Questions Or Mortgage Loan Originator Mortgage Estimator This Or That Questions

8 Great Questions To Ask Your Lender Click To My Blog To See Even More Great Questions Or Mortgage Loan Originator Mortgage Estimator This Or That Questions

Joel Lobb Mortgage Broker Fha Va Khc Usda Google Search Home Insurance Quotes Fha Mortgage Compare Insurance

Joel Lobb Mortgage Broker Fha Va Khc Usda Google Search Home Insurance Quotes Fha Mortgage Compare Insurance

Fha Vs Conventional Loans Comparison Chart Mortgage News Mortgage Realestate Fha Loans Conventional Loan Mortgage Interest Rates

Fha Vs Conventional Loans Comparison Chart Mortgage News Mortgage Realestate Fha Loans Conventional Loan Mortgage Interest Rates

Fha Vs Conventional Comparison Chart Buying First Home First Home Buyer Home Buying Process

Fha Vs Conventional Comparison Chart Buying First Home First Home Buyer Home Buying Process

What Are Conventional Loans And What Are It S Requirements Conventional Loan Loan Mortgage Interest Rates

What Are Conventional Loans And What Are It S Requirements Conventional Loan Loan Mortgage Interest Rates

Take A Closer Look At Va Loan Acronyms Va Loan Loan Va Mortgages

Take A Closer Look At Va Loan Acronyms Va Loan Loan Va Mortgages

Credit Score Requirements Lower As Interest Rates Creep Up Infographic Credit Score Mortgage Lenders Mortgage Loans

Credit Score Requirements Lower As Interest Rates Creep Up Infographic Credit Score Mortgage Lenders Mortgage Loans