Gi Bill Impact On Higher Education

bill higher impactVeterans registering for classes at Indiana University 1947. If they used the benefits they received as of 2012 1564 monthly as a full-time student tiered at lower rates for less-than-full-time for a maximum of 36 months of education benefits.

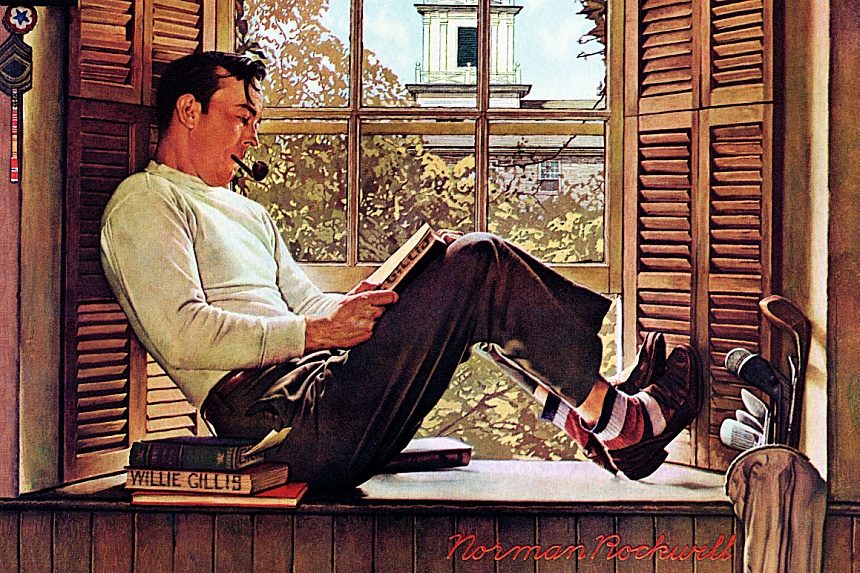

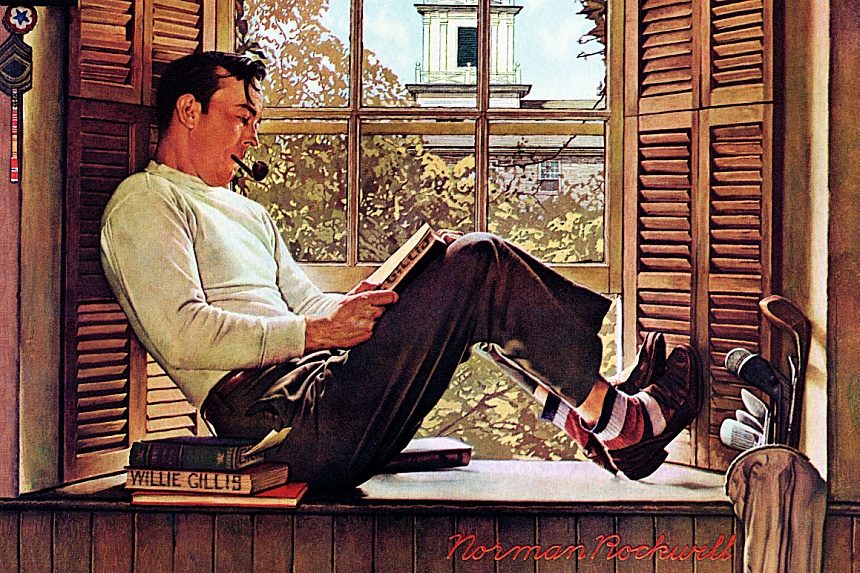

How The G I Bill Changed America The Saturday Evening Post

How The G I Bill Changed America The Saturday Evening Post

First although the New GI Bill has increased overall college enrollment by about 3 percentage points on average the effect was much larger immediately after the bills adoption and has waned in recent years suggesting that part of the initial enrollment burst was due to the retrospective nature of the bill.

Gi bill impact on higher education. Bill held the promise of significantly reducing black-white gaps in educational opportunity and long-run economic outcomes the GI. BILL IS A RECORDING OF SUCCESS. Broadly speaking our study is related to the large literature that examines whether higher education subsidies eg federal education tax credits positively impact college enrollment degree completion and earnings.

At the time few understood the impact the GI Bill would have on college enrollments. For private institutions graduate education and out-of-state tuition institutions may enter into an agreement with the VA whereby the VA will match institutional contributions to cover additional costs. While the introduction of generous student aid through the GI.

Bill Changed the Face of Higher Education in America. Signed into law 64 years ago today the bill promised every GI Joe and GI Jane the building blocks of what would become the American dream. Bill which took effect on August 1st 2009 vastly increased the educational funding available to men and women who served in the armed forces.

Congress estimated that for every dollar spent under the GI Bill the economy got seven dollars back. Bill MGIB and the other is the Post-911 GI. UNDER THE World War II legislation 2232000 veterans attended college at a cost of 55 billion dollars1 For half a decade following the war veterans dominated the nations campuses by their numbers and their academic superiority over nonveteran classmates.

In this study I used American Community Survey ACS 20052015 data to examine the enrollment effect of the Post-911 GI Bill. Bill that are in effect today. This last benefitmoney to put toward a college educationhad unprecedented impacts on veterans and the higher education system alike.

Around 8 million of the nations 16 million veterans took advantage of federal funding for higher education or vocational training 2 million of whom pursued a college degree within the first five. In 1944 the GI Bill provided a monthly stipend of 50 to single Veterans and up to 75 for Veterans with. Bill and Higher Education.

President Franklin Delano Roosevelt signed it into law June 22 just over two weeks after the Allied invasion of Normandy. The Higher Education Act of 1964 extended GI Bill benefits to every. Aware of their opportunity.

The Bill not only led to a massive expansion in higher education but also helped expand the nations economy as a whole. This study examined the impact of the Servicemans Readjustment Act of 1944 the GI Bill on African Americans quest for higher education. 1 How can the.

Though the GI Bill provided many benefits this report will focus on the educational benefits which allowed returning Veterans to attain higher education by covering the cost of the Veterans college tuition. Within the set of education subsidies the PGIB is a very large program. The new post-911 GI.

Success and Surprise THE STORY OF THE GI. Attending not only community colleges but also public and private universities has become affordable for returning veterans for the first time since the WWII GI. Low-cost loans to buy a home and perhaps most important.

Understanding the impacts of the GI Bill expansion has several important policy implications. There are two primary iterations of the GI. One is the Montgomery GI.

Recognizing the swiftly changing face of the American college student LIFE published an extensive cover story in 1947 about student veterans who had come to make up more than 50 of the. It was dubbed the GI Bill of Rights because it offered federal aid to help. Among the more socially significant revolutions wrought by the GI Bill was the impact upon discriminatory practices.

Both may be used for higher education expenses and both are the result of military service. By fall 1945 8000 GIs enrolled in college but by 1946 that number had swelled to one million. And by 1950 to two million.

According to another recent analysis of the nearly 900000 veterans enrolled in undergraduate and graduate programs using post 911 GI Bill and Yellow Ribbon funds only 722 undergraduate veterans are enrolled at 36 of the most selective private non-profit colleges in the United States. Optimists assumed that perhaps 10 of veterans would matriculate and that most would instead seek employment. Why has higher education been so elusive for African Americans.

The Montgomery GI Bill Active Duty MGIB stated that active duty members had to forfeit 100 per month for 12 months. By initial comparison the two seem very similar in the realm of higher education. Bill exacerbated rather than narrowed the economic and educational differences between blacks and whites among men from the South.

With reference to this question the following sub-questions were addressed. Blacks and Jews in particular were able to use the GI Bill to break barriers to. The central question guiding this study follows.

The Post-911 GI Bill is designed to cover tuition and fees for in-state public undergraduate higher education for eligible veterans. The GI Bill they write made possible the education of fourteen future Nobel laureates two dozen Pulitzer Prize winners three Supreme Court justices and three presidents of the United. The analysis resulted in three main findings.